What is a bid Bond?

Basically when you’re bidding a project that requires a bid bond it’s because the owner wants you to guarantee that you’re capable of fulfilling the contract requirements and that you’ll be able to secure a Performance & Payment Bond.

Usually a bid bond will roll into a performance bond.

So, what happens if you back out of a bid where you were the successful low bidder and for which a bid bond was issued on?

If you’re the low bidder and you decide not to execute the contract and you want to backout and you provided a bid bond to bid the project. The owner will file a claim against you and your surety company.

If you’re a small company most likely you put up some form of collateral or personal guarantee. You’re personally and financially responsible for the cost difference for the owner to secure the next lowest bidder up to your bond amount.

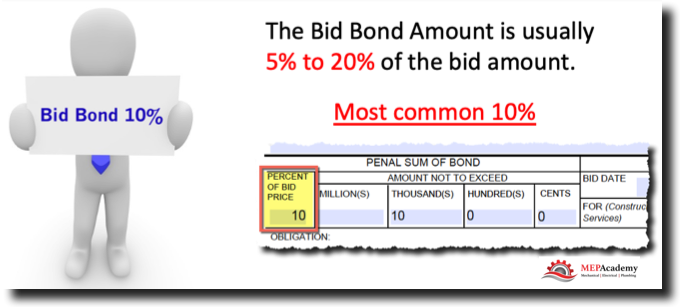

So, if you bid a $100,000 and the next lowest bidder was $110,000, and your bid bond was in the amount of 10%, your liability is the difference between your bid and the next lowest bidder, which makes you liable for the $10,000 difference if you decide not to execute the contract.

So, if you back out, you’re liable to your bond company for the claim amount plus attorney fees. So, they can come after you if you don’t pay the claim amount and the attorney fees. Read your contract to determine your liability exposure.

It’s almost better to perform the contract knowing you’re going to take a loss, at least you might be able to mitigate the loss with careful planning and great project management while hopefully there’ll be change-orders allowing you to recover some of the loss incurred on the base bid amount.

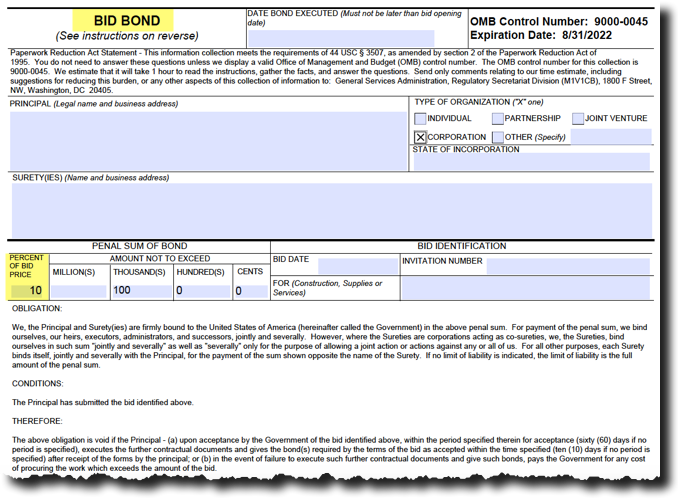

Bid bonds are usually in the range of 10%, but can vary depending on the contracting authority.

The bid bond percentage will be indicated in the bid documents.

Again, to reiterate. If you back out and you made a personal guarantee, then your personal assets could be at risk, so you want to read the fine print. You want the bond company to explain to you the terms and conditions of the bond.

Often there will be alternatives to a bid bond, such as submitting a cashiers check, certified check or a money order, or some other asset that can make good on your promise to execute the contract if you’re low bidder. Other assets that might be considered are liquid assets, that is something that can be converted into cash easily.

When are bid bonds required?

Most likely on all your Federal, State and Local Municipality projects.

Are bid bonds required on privately held or funded projects? A lot of project are now requiring bid bonds. We’ve seen as the larger the project gets, the greater the chances there will be a requirement to bond the project.

If you are going to be bidding in the Government sector or within the larger private sector projects than you need to build up your bonding capacity. You can’t just start a company and expect a surety company to issue millions of dollars’ worth of bonds on your behalf unless you back it up with collateral and have established record of completing bonded work, and have the area of experience required to complete the proposed project.

The bonding company will also tract how much bond exposure you have outstanding. This is for any work which is currently under bond coverage, and for which is yet to be completed, releasing the bond of any further risk.

So, how much do bid bonds cost?

For projects over $400,000, the bid bond could be free. If you have a good relationship with your bond company then it’s possible there won’t be any charge. For smaller projects there may be a nominal fee of say $100. It’s possible that they have an annual fee, which covers all the bid bonds you would need for the year. Check with your bonding company to discover how they structure their fees.

What happens if you submit a bid without a bid bond on a project that requires a bid bond. What will they do? Your bid will definitely be rejected. They will not accept your bid, even if you are low bidder.

What are Performance Bonds?

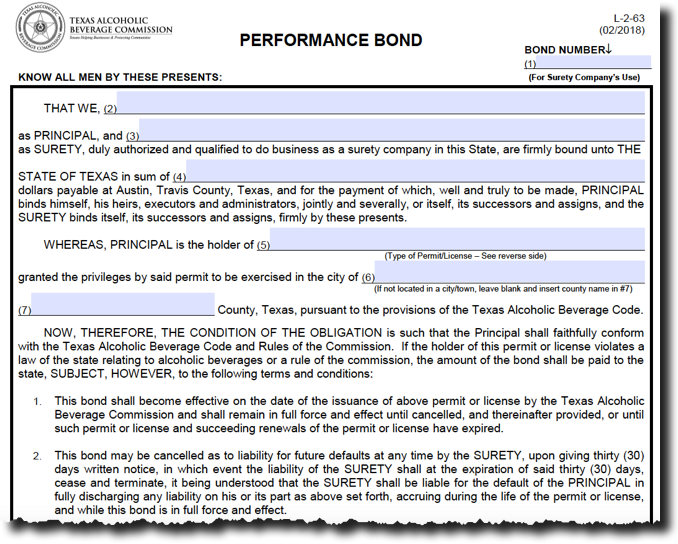

They’re used to ensure the project gets completed according to the construction documents. The bid bond usually also guarantees that your surety will issue a performance bond if you’re the successful responsible low bidder. Unlike the bid bond, the performance bond will definitely cost you some money. This is where the surety company gets their money, especially if they offered you the bid bond for free. They know that following a successful bid, you’ll need to pay for the performance bond.

Now with a Performance bond in place, what happens if you fail to perform? You’ve gotten this far and have been executed, that is signed the contract and are now required to perform. If you don’t perform then the bonding company will pay to have the project completed. So your bonding company will either payout to the owner or General Contractor whatever it takes to finish the project that you were contractually obligated to finish. The bonding company may pay another company to finish the contract, but they make risk having to pay more than what the original bond amount was issued for.

Maybe you file bankruptcy or something. They will make your surety company pay to complete the project. You can see why the surety companies want to make sure that you have the experience and financial resources required to complete the project that you are attempting.

The penalty is usually 100% of the contract amount.

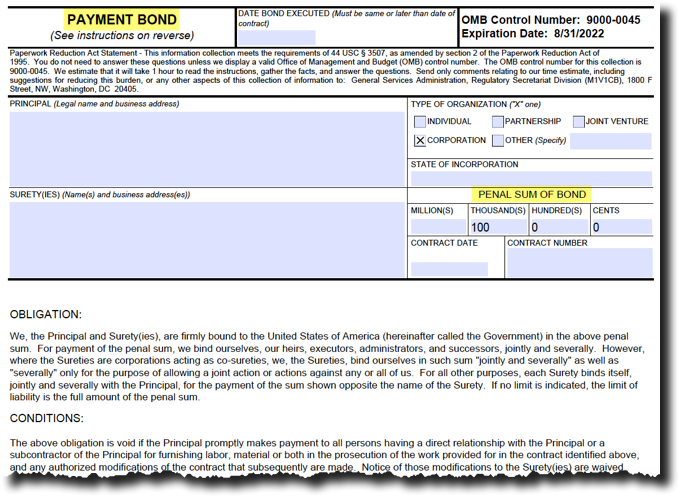

What are Payment Bonds?

The payment bond is usually coupled with the performance bond. The payment bond ensures that you pay those who provide material or labor on your behalf for the proposed project. They want to be sure that you have paid all your subcontractors, equipment and material suppliers, including all the labor used on the project that the bond was issued for.

How much does a Performance & Payment Bond Cost?

Performance and payment bonds are often issued as one bond except in some locales where maybe it’s just a performance bond.

Bond Rates can vary from less than 1% up to 2% or more depending on the contract amount, your experience and credit rating.

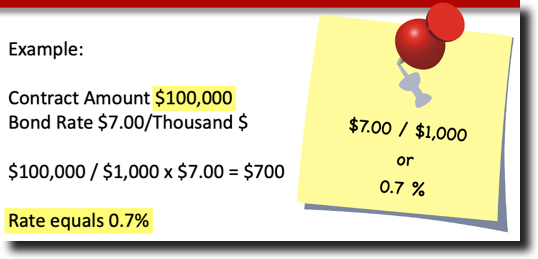

For example, let’s say that you had a construction contract in the amount of $100,000 and your bond rate was $7.00 for every $1,000 of contract. Or stated as 0.7% of the total contract amount.

So your cost calculation would look like this:

Calculation #1

Take the $100,000 divided by the $1,000 to get how many thousands there are. As each $1,000 of contract amount will cost you $7.00.

$100,000 / $1,000 = 100 x $7.00 = $700

Calculation #2

Take the $100,000 times 0.7$

$100,000 x 0.7% = $700

If you are just starting out then your bond rates will most likely be higher than this amount, but as you gain experience and grow your credit your rate can eventually be lower than this. Check with your bonding company for the rate structure.

How do you Qualify for a Bond?

Small companies may be require to have the owner pledge a personal guarantee. That is the small company owner personally guarantees to reimburse the bonding company for any claims against the bond. So you really want to think this through if you are a small company and are thinking of securing a bond for a project. You want to make sure that you have all your cost covered and you have an experienced team to execute the contract documents, including the funds to pay for the project as often accounts payable will exceed accounts receivables.

So if you’re a small company its possible you’ll have to provide a personal guarantee, and if your married than your spouse might also be required to sign the guarantee. Check with your bonding company or shop around for the best terms and conditions.

Large companies usually qualify based on their credit rating and experience. So until you get some experience and establish some credit behind you, you may have to give a personal guarantee.

In summary the bonds are insurance that you will do what you said you would, and that is, to execute the contract if you are low bidder and pay all those who helped you build the project, whether that was your subcontractors, or the vendors that sold you equipment or materials, and the workers that perform labor on your behalf.