Chapter # 5 – Labor Rates

Union Labor Rates

In 2018, according to the US Government Bureau of Labor Statistics 10-1/2% of the wage and salary workers were union members. Non-union workers weekly paycheck is 82% of that of a union worker. Of course this varies by region and worker classification, as the largest union membership belongs in the educational (Teachers) and Protection Services (Police, Fire) sector. Most of the union works are in the public sector (33.9%) as opposed to the private sector (6.4%). Here is a sample of union labor rates for Sheet Metal Local Union 104 for San Francisco and surrounding areas in Northern California. Sheet Metal Local Union 104.

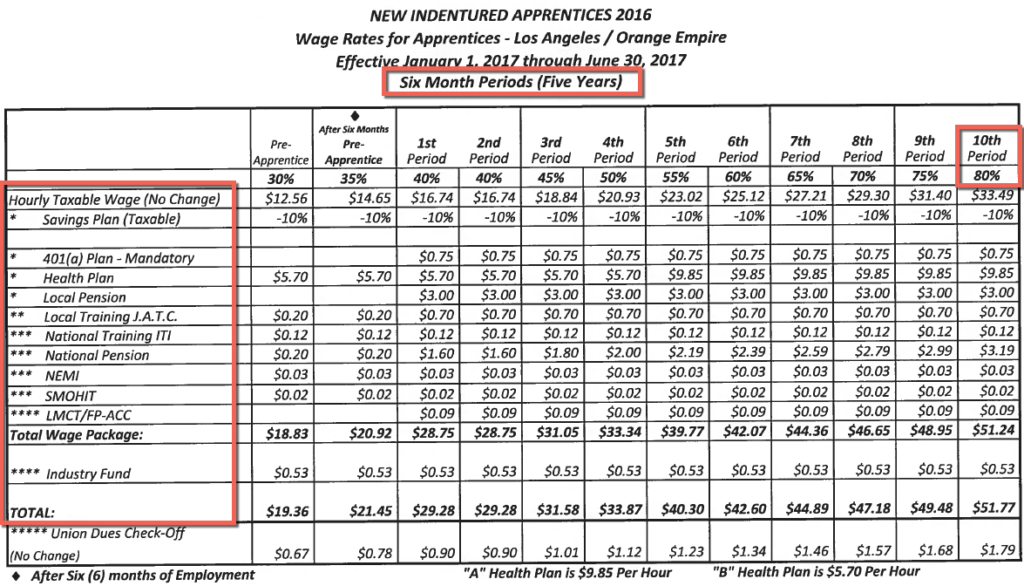

They can be a little confusing to read as each union includes or excludes different cost from their wage calculation and they use different acronyms. Below is an older version of the wage rate breakdown for an apprentice local 105 sheet metal worker. The apprentices hourly base rate is based on a percentage of the Journeymen’s wages. All wages are calculated as a percentage of the Journeymen as reflected in the first row which shows a percentage. As an example a 10th period apprentice earns 80% of what a Journeymen earns based on this wage sheet.

Included in the apprentices wages is the following;

- Base wage (Hourly Taxable Wage). Here it indicates that they received a raise or increase over the previous period.

- Savings Plan 10% (Its indicated that the savings plan is taxable)

- 401(a) Plan (This is a mandatory participatory plan as opposed to a 401(k) which is voluntary.

- Health Plan

- Local Pension

- Local Training J.A.T.C.. (This compensates the union for the expense of training)

- National Training

- National Pension

- NEMI

- SMOHIT – Sheet Metal Occupational Health Trust

- LMCT – Labor Management Cooperation Trust

Labor Rates and Crew Size

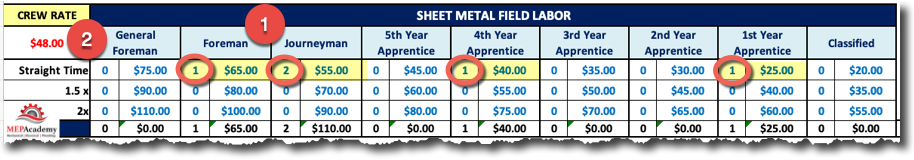

With the MEP Academy Estimating Spreadsheet there are convenient labor tables for entering labor rates for various classes of workers whether union or non-union. Below is a screen shot from the spreadsheet where you choose how many workers you want at each skill level from a classified worker all the way to general foreman. Item # 1 are the different levels of workers and their pay rates for straight time, time and a half and double-time. By selecting how many of each worker type you need, the spreadsheet will calculate the crew rate shown as $48.00/Hour and indicated as item #2 below.

The layout of the labor table is similar to how sheet metal unions classify their workers, but any non-union company can set up the labor table according to their own levels of skilled workers.

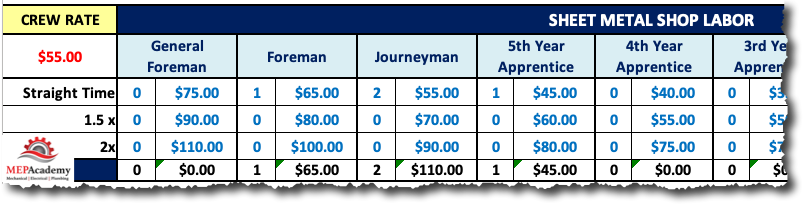

The same applies for the Fabrication Shop if your company has one. Having these labor rate tables as part of your estimating spreadsheet provides for fast calculation of crew rates. It also provides a convenient location to keep the labor rate information used for a particular project.

Labor Agreements

Depending on the type of project you are bidding on, there may be requirements to comply with various labor agreements such as a PLA (Project Labor Agreement) or Davis Bacon.

Project Labor Agreement (PLA)

Here is the definition of a Project Labor Agreement according to Wikipedia:

A Project Labor Agreement (PLA), also known as a Community Workforce Agreement, is a pre-hire collective bargaining agreement with one or more labor organizations that establishes the terms and conditions of employment for a specific construction project. Before any workers are hired on the project, construction unions have bargaining rights to determine the wage rates and benefits of all employees working on the particular project and to agree to the provisions of the agreement. The terms of the agreement apply to all contractors and subcontractors who successfully bid on the project, and supersedes any existing collective bargaining agreements.

PLAs are used on both public and private projects, and their specific provisions may be tailored by the signatory parties to meet the needs of a particular project. The agreement may include provisions to prevent any strikes, lockouts, or other work stoppages for the length of the project. PLAs typically require that employees hired for the project are referred through union hiring halls, that nonunion workers pay union dues for the length of the project, and that the contractor follow union rules on pensions, work conditions and dispute resolution.

PLA’s can require non-union employees to pay union dues and follow union rules for the duration of the project. Be careful if the project you are bidding requires a PLA as this will increase the cost of your labor, especially if you are a non-union contractor with much lower rates than a typical union contractor.

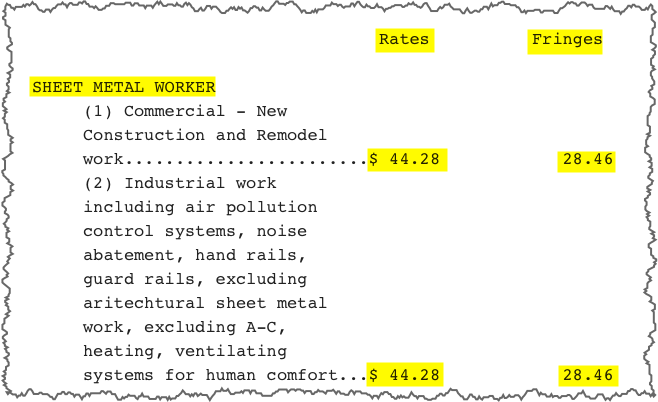

Davis-Bacon Prevailing Wage Rates

The Davis-Bacon Act, as amended, requires that each contract over $2,000 to which the United States or the District of Columbia is a party for the construction, alteration, or repair of public buildings or public works shall contain a clause setting forth the minimum wages to be paid to various classes of laborers and mechanics employed under the contract. Under the provisions of the Act, contractors or their subcontractors are to pay workers employed directly upon the site of the work no less than the locally prevailing wages and fringe benefits paid on projects of a similar character. The Davis-Bacon Act directs the Secretary of Labor to determine such local prevailing wage rates.

Davis-Bacon Wage Rates are established by the U.S. Department of Labor. The Davis-Bacon act was originally enacted in 1931 during the great depression. The purpose of the act was to establish fair wages on Federal construction projects. For any project where the Davis-Bacon act is applicable, the local wages will be published for the various classes of workers. The Davis-Bacon act applies to all subcontractors that your company hires.

Non-Union Labor Rates

Non-Union Labor Rates are established by local conditions and the company hiring. The rates will vary by location depending on the availability of labor and the economic construction conditions. If you have a project that is bidding out of the area you normally build in, then you might have to pay subsistence for the travel and housing of any employee that you will use on that project. Labor rates will be different in Los Angeles, California compared to Derby, Kansas.

Fringe Benefits

Fringe Benefits are cost added to the base taxable wage rate and are usually found in Union contracts. These benefits might include retirement plans, health plans, local pensions, local training and national training funds. The Fringe benefits can add anywhere from 30% to 70% more of the base taxable wages. If you had a base taxable wage of $20.00, this could mean a total hourly wage packaged rate of anywhere from $26.00 to $34.00. The Unions publish their wage rates for their Union members, which includes a breakdown for the various classifications of workers from apprentice to general foremen.

Federal, State and Local Legal Requirements

There are mandatory legal requirements to make payments to various governmental agencies on behalf of the employees taxable hourly wage rate, in addition to the employer’s obligation for additional payments.

Federal Insurance Contributions Act (FICA)

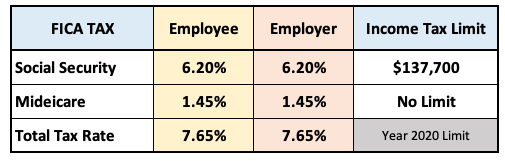

The Federal Insurance Contributions Act (FICA) is a United States federal payroll contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

Social Security tax amounts to 6,2% of wages up to a maximum $137,700, any wages above that amount aren’t subject to FICA taxes. The Federal government double dips on the Social Security tax by having the employee and employer both pay 6.2% of the employees’ wages, for a total tax of 12.4%. The employee pays 6.2% of their wage while the employer pays another 6.2% from their own funds. This may show as OASDI on your paycheck, which stands for “Old Age, Survivors and Disability Insurance”.

Medicare: Then the Federal Government deducts 1.45% from the employee’s paycheck and another 1.45% paid by the employer for a total of 2.9% for Medicare. The employee pays 1.45% from their paycheck and the employer 1.45% from their own funds. The Medicare portion has no maximum cap on the amount of income the employee makes that’s taxed.

This brings the total tax to the employee at 7.65%, made up of 6.2% for Social Security and 1.45% for Medicare. The percentage of the FICA taxes has stayed steady for a long time, it’s the Income limit that gets raised more often.

If you make more than $200,000 in 2020, then there is another 0.9% added to the Medicare portion for single filers.

Federal and State Unemployment Taxes

The Federal Unemployment Tax rate (FUTA) is currently 6% minus a 5.4% credit if you paid state unemployment taxes for a net tax of 0.6% of the first $7,000 of employee wages. The calculation equals a total tax of $42 for the year, figured as such; $7,000 x 0.6% = $42

The State Unemployment Insurance (SUI) tax rate varies by state and by the employer’s history of the number of employees laid off the previous year and the amount they pay their employees.

Workers Compensation

Workers Compensation payments vary by state, trade and by contractor’s accident rate. The lower your accident rate the better your workers compensation rate. This is why is imperative to have a safety program in order to educate your employees to work safe and to secure a lower workers compensation rate. There are some projects that will ask for your incident rate, and disqualify your company if your safety record is above a certain number.

These additional taxes are calculated against the employee’s taxable base rate, not including the fringe benefits.

Construction Laborers

Calculating Labor rates

Figuring out your labor rates should start with the going rate for the type of labor you need. If its a sheet metal worker with Journeymen experience then in your geographical area there will be an expected wage range.. If you are a Union company then you will abide by your local sheet metal unions negotiated rates per the bargaining agreement and that are published on a regular schedule. If you aren’t held to a bargaining agreement, but are left to set your own labor rates, then there are a few ways to go about figuring what to charge per hour for various skill levels and department functions.

Determining how much to charge per hour for various levels of skilled and unskilled workers can make the difference between losing a bid because your labor rates are too high and winning the bid but finding out that your labor rates don’t cover all your cost. First you need to develop a base rate like that shown in the union labor rate breakdown table above.

Foreman and Journeymen Vehicles

There are several methods that contractors use to cover the cost of your foremen and journeymen vehicles. You can add them to labor burden on top of the hourly rate or charge them to each job based on project duration. At some point accounting has to determine the method of cost recovery, so we just include it here so that you give it some thought.

Overtime and Shift Labor Rates

When required to work overtime or swing shift, certain values in your straight time labor rate will need to be adjusted to account for this additional requirement. The Fair Labor Standards Act (FLSA) is a Federal Law which establishes minimum wage, overtime pay, and which requires that you pay non-exempt employees 1-1/2 times their regular pay rate for all hours worked in excess of 40 for any work week. FLSA requires that you pay 1.5 times the regular rate of pay for all hours worked in excess of 8 per day and 40 per week for non-exempt employees.

The federal overtime provisions are contained in the Fair Labor Standards Act (FLSA). Unless exempt, employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. There is no limit in the Act on the number of hours employees aged 16 and older may work in any workweek. The Act does not require overtime pay for work on Saturdays, Sundays, holidays, or regular days of rest, unless overtime is worked on such days.

The FLSA applies to employment within any state of the United States, the District of Columbia or any territory or possession of the United States. An employee working in a foreign country is not protected by the FLSA even though the employer has its main office in the United States.

For some unions there is an extra premium for working shift hours, so if you work for a union company check the union agreement for overtime and shift hour payment requirements.

Union Concessions

Some of the sheet metal unions provide assistance for their union members when competing against non-union contractors on a competitive bid. These funds go by various names such as Market Recovery Funds, or Equality Funds. These funds help with the labor rate differences between union and non-union contractors in an attempt to level the playing field in the labor cost category. The Union may give a $20 dollar per hour reduction for their journeymen and $10 dollar reduction for their apprentices. The rates and concession amounts vary, and are only good for as long as the money in the fund is available.

Get the MEP Academy Estimating Spreadsheet here >>> MEP Academy Estimating Spreadsheet

Understanding the MEP Estimating Spreadsheet (Free Course)

- Chapter #1 – HVAC Equipment

- Chapter #2 – HVAC Quotations

- Chapter #3 – Subcontractors

- Chapter #4 – Sheet Metal Material and Labor Summary

- Chapter #5 – Labor Rates

- Chapter #6 – Rentals

- Chapter #7 – General Conditions

- Chapter #8 – Finalizing the Estimating Spreadsheet