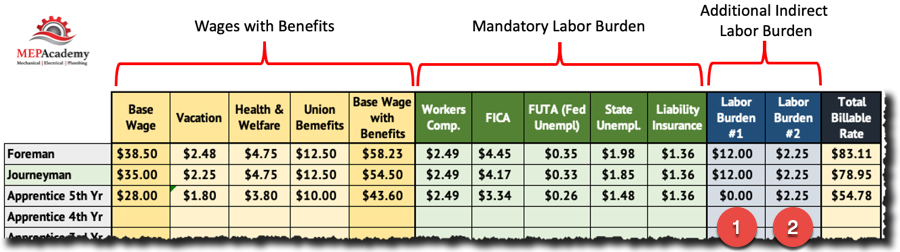

There are two types of Construction Labor Burdens, one is mandatory and the other we’ll call additional Indirect Labor Burden. We’ll explain the difference and show you how to figure construction labor rates with burden. Applying the mandatory burden rate is basic math dependent on the current rates dictated by government agencies. There are no options with these cost and they’re directly related to the employees earned wages.

If you Prefer to Watch a Video of this presentation, scroll to the bottom for the Video or Click this link —-> Construction Labor Rates with Burden

Additional Indirect Labor burden rates are not dictated by law but are required for you to recover the cost of certain aspects of running a construction company, often referred to as indirect cost, a part of operating expenses.

Labor wages are built from the three categories of Labor, 1) Employees Base Wage & Benefits, 2) Mandatory Labor Burden, and 3) Additional Indirect Labor Burden

#1 Wages and Benefits (Base Wage)

- Base Wages

- Vacation

- Health & Welfare

- Union Benefits

#2 Mandatory Labor Burden (Mandated by Law to Pay)

- Workers Compensation Fund (Can be self-insured)

- FICA

- FUTA (Federal Unemployment Tax)

- State Unemployment Tax

- Liability Insurance (Can be included Elsewhere)

#3 Additional Labor Burden (Cost to be Recovered)

- Vehicles (Lease payments, Maintenance, Gas, Repair, etc.)

- Small Tools

- Uniforms

- Cell Phones, iPads, etc.

- Training

- Warranty Cost

- Travel

- Supplies

- Non-working Hours

There are several ways to handle these additional cost when running a construction company. A company can either add these cost to the labor rate as we’ll show you in a minute, or you can add them as a percentage of a line item on your estimating spreadsheet. Here are the steps to take.

Step #1 – Determine the Annual Cost for Each Category

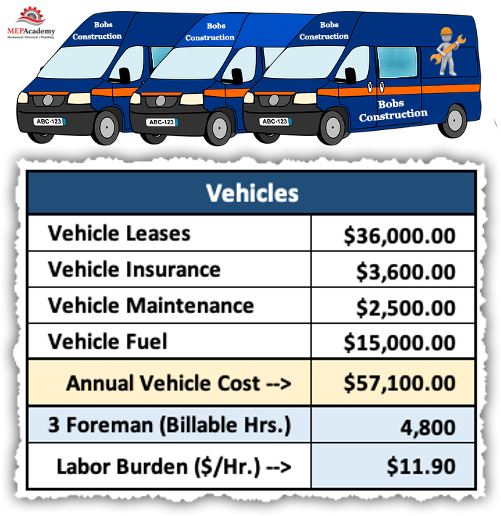

Depending on how you plan to calculate the various categories of cost, or based on the capabilities of your accounting system, cost should be broken out in as fine a detail as makes sense for your company. Here is an example for three Foreman that are provided with company vehicles.

Example:

- Vehicle Leases $12,000 x 3 = $36,000/Year

- Vehicle Insurance = $3,600

- Vehicle Maintenance = $2,500

- Vehicle Fuel = $15,000

- Total Annual Vehicle Cost = $57,100

Step #2 – Determine Billable Hours (Hours Paid vs Billable Hours)

Company employees will be paid for days that they’re not at work (Vacation, Holidays, Sick Time), and for days working but not billable (Training, Meetings, Misc.). The net will be the employee’s billable hours. Using the previous year’s billable hours as a starting point, add your projected billable hours for the current year for all the employees you are calculating a burden rate for. Here is a quick look at the 3 Foreman we used in the above vehicle example, and the two ways to look at this; the right way (billable Hours) and the wrong way (paid hours).

- Employee Paid Hours = 2,080 x 3 Foreman = 6,240 Hours

- Employee Billable Hours = 1,600 x 3 Foreman = 4,800 Hours

If Burden Recovery Based on:

- Paid Hours ($57,100 / 6,240 Hrs. = $9.15/Hr.)

- Billable Hours ($57,100 / 4,800 Hrs. = $11.90/Hr.)

You can see that if you used the paid hours to try and recover the cost of furnishing a vehicle for these employees, you would end up short of the cost. Actual Billable Hours x $9.15/Hr. = $43,920, a difference of <$13,180>.

The correct method is to use billable hours, which is 23% less than paid hours, or stated differently you have an employee utilization rate of 77%.

Billable Hours / Paid Hours = 77%

Step #3 – Calculate Labor Burden Rate

Take the total cost for any category and divide it by the total billable hours applicable to that category. In the example above we were only looking at Foreman Vehicles, and how much cost we needed to added to their hourly rate to recover the cost of furnishing the Foreman with those vehicles. ($57,100 / 4,800 Hrs. = $11.90/Hr.)

This can be done for any department where you can track the cost, and then divide those cost into the billable hours for those employees to derive at a labor burden rate.

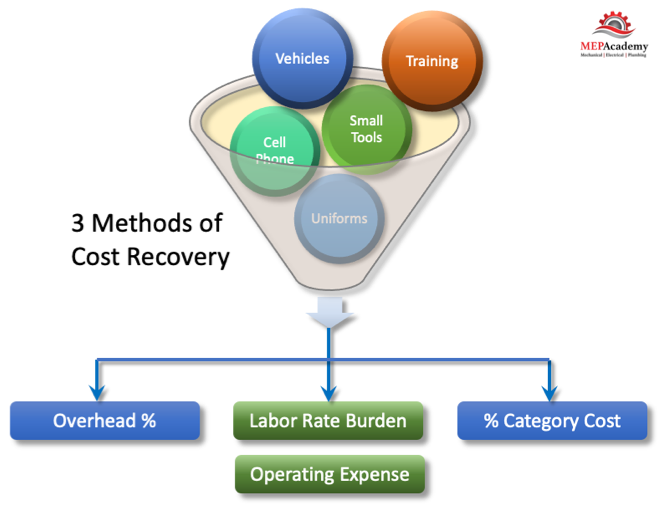

Three Methods of Cost Recovery

The following three methods of cost recovery are the ones we have seen most commonly used from small to large contractors. Smaller companies tend to lack the accounting software and personnel to track cost by categories. They might use of a flat percentage rate, like adding 30% to direct labor, or add these cost to their overhead percentage, which is mixing overhead expenses with operating expenses.

For an example let’s say a small company has the following cost that they want to recover, this is in addition to the Mandatory Labor Burden which is easily calculated.

Operating Expenses

- Vehicles $57,100

- Small Tools $10,000

- Uniforms $3,200

- Cell Phones $8,500

- Training $2,800

- Total $81,600

Project Revenue & Cost for Previous Year End

- Total Revenue $1,200,000

- Project Cost $1,000,000

Total Billable Hours

- (3) Technicians with Trucks 4,800 Hrs

- (2) Helpers (No Vehicle) 3,200 Hrs

- Total Billable Hours of 8,000 Hrs

Overhead Method

The expenses we are talking about are related to “Operating Expenses” as opposed to true “Overhead Expenses”. But, for smaller companies that lack the accounting system required to track cost according to some categorization, the use of the overhead percentage makes for a quick calculation. They take all their indirect expenses, and divide it into total project cost, to come up with an additional percentage to add on top of their normal overhead percentage.

$81,600 Operating Expenses / $1,000,000 Project Cost = 8.16%

Labor Burden Method

With this method there are several approaches as we already demonstrated one of them using the vehicle cost above divided by the billable hours of the Foreman. ($57,100 / 4,800 Hrs. = $11.90/Hr.). The second method is to take the total ‘Operating Expense and divide it by the total billable hours including the helpers. We prefer the first method as being more accurate, because it’s the Foreman who are benefiting from the vehicles and it is their hours that dictate the usage of the vehicle, but here is what it might look like as an overall labor burden to every category of labor.

$81,600 Operating Expenses / 8,000 Billable Hours = $10.20 / Hour

% Category Method

With the “% Category Cost” method, total the cost related to a particular category, such as small tools or warranty cost, and then divide that into one of the cost items in your estimate, whether total cost or total labor cost to get a percentage to use when bidding new work. For example adding 1% of total labor on each bid to cover the cost of small tools. Here we use total project cost.

Small Tools $10,000 / $1,000,000 Project Cost = 1%

Or if you had a project manager that was costing you $50,000/year you could add 5% to every bid to cover this cost based on the company performing $1,000,000 in cost a year.

Project Manager $50,000 / $1,000,000 = 5%

With any of the three methods above there is a chance of not recovering your full cost. This occurs in each of the three methods because of the following;

Cost Recovery Methods

#1 Overhead % – The company can fall short of full cost recovery because they didn’t meet their sales goals, and didn’t perform the total amount of work in gross dollar amount to recovery the predicted cost.

#2 Labor Rate Burden – The company can again fall short of total cost recovery because they didn’t charge enough billable hours during the year to recover the cost. Remember the labor burden is based on a number of billable hours occurring in the year, if that doesn’t happen, then you fall short of recovering your cost for those items.

#3 Category Cost – the same thing happens to category cost when the category used for the calculation doesn’t hit the amount used to forecast the threshold for full cost recovery. If you figured small tools at 1% of your labor cost and you didn’t have as much labor this year as expected, than you won’t recovery your small tools cost.

Labor Burden Recovery Fund

The construction labor burden isn’t part of the employees take home pay, but part of a pool of money to be recovered for the cost of various items of the trade needed to carry out the business. You can have a labor recovery fund for various departments or categories of cost, for instance; Foreman Trucks, Shop Fabrication, Detailing Department, Project Management, Small tools and equipment. These are just a few of many possibilities.

The important thing to know is what these cost are annually, so that you can account for them in your hourly rate or as a percentage of cost on your estimating spreadsheet. The companies accounting system should be able to tell you what you have spent on various cost categories, we’ll call them Cost Recovery Buckets. If you have a Vehicle Cost Recovery Bucket, then you’ll need to fill that bucket by the end of the year with enough money to pay for all the cost associated with the vehicles you provided your employees for that year.

Other Methods of Cost Recovery

There are different ways being advocated for figuring construction labor rates with burden, with the most common being the addition of a percentages of your direct labor cost. For example, some contractors may just add 30% to their direct cost (Wages with Benefits) and call it a day. But is this accurate; are you sure you have recovered all your cost? For smaller companies this might work, but as you grow, the buckets of cost to recover start to grow and will need a deeper analysis.

Labor Burden Review and Tracking

It’s important to track and review your labor burden calculations on a regular basis. The time interval will depend on the size of your company and the ability of your accounting software to report the proper information. You may want to review the numbers every quarter, or semi-annually, but the more frequent the better to allow you to make adjustments as needed to meet the actual cost.

Were you under recovered, or did you work more hours than forecasted and have a surplus in your recovery account?

How to Establish a Labor Burden Rate for Your Company

You may need to calculate more than one labor burden rate based on the various classifications of workers or departments. For instance, you might have Electricians, Plumbers, HVAC Technicians, and then within each of these trades there maybe various levels of experience that warrant an increase in their labor rate for various benefits, such as providing all Foreman and Journeymen with trucks. This would then require you to recover the cost of the vehicle and the associated cost of maintaining and operating the vehicle.

You might also want to calculate the burden rates based on departments, such as, Sheet Metal Fabrication Shop, Detailing Department or Warehouse and Shipping. The point is to understand the cost of providing the particular benefit and then recover the cost by adding a labor rate burden to that category of labor or use a percentage of cost line item on your estimating spreadsheet. Each company will look at this differently based on their modes of operation and the sophistication of their accounting system to track these cost.

There are various cost of running a construction company that may not be covered by your overhead and profit margin. Labor burden is cost in addition to your wages and fringe benefits. Knowing your labor burden will help you set the correct labor rate for all your work.

Summary

Having a good accounting system will make calculating construction labor rates with burden easier. Be sure your accounting software allows for categorization of cost according to your needs. Understanding all the indirect cost associated with your labor is important in running a successful business. The important thing is to understand these cost and develop the most accurate way of tracking and measuring them before the year is over and it’s too late to make an adjustment. One of the ways to add more money to your recovery fund is to perform more billable hours than anticipated.